( Image: ACB News)

█ By ACB News / David Niu | 11 June 2025

In an exclusive report published on Monday titled “[U.S. Market Watch] Wall Street Rises at Start of June, Dow Could Head Towards 45,000 – Further Signals Needed to Confirm Trend”, we noted that despite a late-week pullback, the overall trend of the Australian equity market remained upward.

If global markets continue to maintain a positive risk appetite, the Australian share market appears well-positioned to push for further record highs. Particular attention should be paid to sectors and individual stocks that have undergone meaningful corrections—especially those that previously rallied on high volumes and then consolidated on lower volumes. Fundamental developments and volume dynamics in these areas merit close monitoring.

On Wednesday, the ASX indeed delivered a fresh all-time high as anticipated.

During morning trade section on 11 Jun Wed , the ASX 200 index reached 8,639 points, surpassing the previous high of 8,615 points recorded on Valentine’s Day (February 14), setting a new record for the benchmark index.

On Wednesday, 11 June, the ASX 200 index surged to an all-time high of 8,639 points during the morning trading session, surpassing the previous high of 8,615 set on Valentine’s Day (14 February).

One notable feature of this week’s market activity is the resurgence of trading momentum across key sectors and select individual stocks, indicating a broadening of investor participation.

As highlighted in “ASX Ends May on a High Note! ACB News Weekly Wrap-up of Listed Company Updates and Market News (2025/6/2)”, the divergence in May between the index and many individual stock performances had become increasingly stark. Continuation of this trend could weigh on investor sentiment and confidence.

The gold sector, however, has been a notable exception. Supported by elevated gold futures and spot prices, several gold stocks remain among the market’s top performers year-to-date.

Some gold exploration companies—such as Barton Gold Holdings Ltd (ASX: BGD) and Solstice Minerals Ltd (ASX: SLS)—have seen strong recent momentum. Both stocks have reached all-time highs since listing, outperforming the broader market, as they progress into new exploration phases with potential drill results expected soon.

Meanwhile, advanced-stage gold developers like Meeka Metals Ltd (ASX: MEK), which have already delineated mineral resources and are entering mining and processing stages, continue to show resilient upward trends in the secondary market.

The lithium sector, after nearly two years of significant corrections, has also shown tentative signs of a turnaround. Pilbara Minerals Ltd (ASX: PLS) touched multi-year lows last week but has since rebounded with renewed trading volume.

On Wednesday, PLS rose 6.67%, bringing its month-to-date gain to approximately 14%. If the current rally continues with solid volume, it will be important to watch whether the stock can break above long-term downtrend resistance levels.

In a late-May exclusive titled “[Exclusive] Trump’s ‘New Nuclear Policy’ Ignites Uranium Market – Can the Rally in Uranium Stocks Continue?”, we pointed out that U.S. nuclear policy reforms had ignited renewed interest in the uranium sector. On Tuesday, shares of Paladin Energy Ltd (ASX: PDN) and uranium enrichment technology firm Silex Systems (ASX: SLX) hit fresh year-to-date highs. However, both pulled back on Wednesday, and the sector’s near-term outlook will likely be shaped by movements in uranium oxide prices.

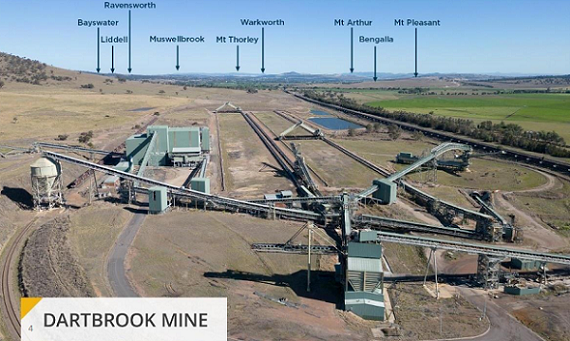

The coal sector has also seen a resurgence in trading activity. Since last week, Coronado Global Resources Inc (ASX: CRN) experienced abnormal trading volume and a sharp price rebound. Within just a few sessions, its share price surged from AUD 0.10 to an intraday high of AUD 0.225 on Tuesday. However, after touching that level, the stock fell sharply and closed down 8.11%, forming a large bearish candlestick—suggesting the rally may be facing near-term selling pressure or entering a consolidation phase. (See: “[Stock on the Move] Coronado Global Resources Inc (ASX: CRN) Signs $150 Million Refinancing Deal with Oaktree Capital”)

Going forward, whether trading activity and volume across sectors and individual stocks can remain elevated will be critical in assessing the next phase of the market’s direction.

As noted in our Monday exclusive, if global risk appetite remains positive, the Australian market could retain the momentum to test further highs. Stocks and sectors that have undergone deep corrections—particularly those supported by solid fundamentals and rising volumes—warrant closer observation.

Some popular thematic stocks , such as antimony mining stocks that had previously shown strength, have seen notable pullbacks this week—possibly signaling the start of a short-term consolidation phase.

It is worth noting that over the past two years, each time the index hit a new high, the market often experienced a period of volatility and pullback afterwards. Whether this new high will trigger a similar pattern remains to be closely watched.

Disclaimer:

This article is for informational purposes only and does not constitute financial advice or a recommendation to buy or sell any securities. Readers should conduct their own research or consult a professional advisor before making investment decisions.