( Image: ACB News)

By ACB News Stock Market Editorial Team

Solstice Minerals Limited (ASX: SLS) announced on Monday that it has received a firm commitment from institutional investor Paradice Investment Management for a $2.13 million strategic placement. Upon completion, Paradice will become the company’s largest shareholder, holding a 9.90% stake.

Following the announcement, Solstice shares surged in early trade to hit an all-time high of A$0.30—its highest price since listing.

ACB News (Sydney 17 June 2025): Western Australia-based gold exploration company Solstice Minerals Limited (ASX: SLS) announced on Monday that it has received a firm commitment from institutional investor Paradice Investment Management for a $2.13 million strategic placement. Upon completion, Paradice will become the company’s largest shareholder, holding a 9.90% stake.

The placement will comprise approximately 8.87 million new shares at an issue price of A$0.240 per share, representing:

——a 9.4% discount to the last closing price of A$0.265 (13 June 2025), and

——a 1.8% premium to the 15-day volume-weighted average price (VWAP) of A$0.236.

The new shares will be issued under the company’s existing placement capacity pursuant to ASX Listing Rule 7.1A, with completion scheduled for 20 June 2025.

Paradice, founded by David Paradice in 1999, is one of Australia's most respected institutional fund managers, known for backing high-growth, early-stage resource companies

Proceeds to Fund Gold and Copper Projects

Funds raised will support Solstice’s ongoing exploration programs across key Western Australian assets, including:

——Targets at Bluetooth, Edjudina Range, and Stateman Well within the Yarri Gold Project;

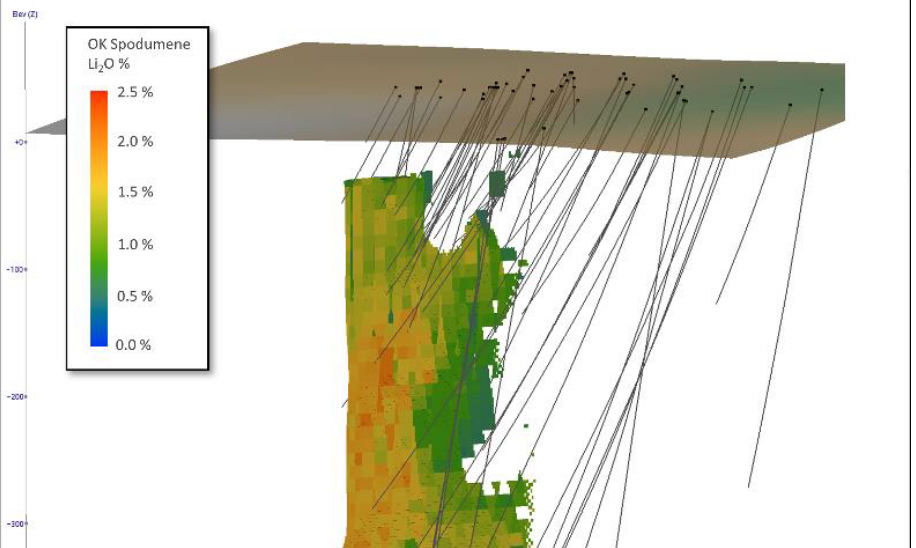

——Resource extension drilling at the Nanadie Copper-Gold Project, which currently holds an inferred MRE of 162kt copper and 130koz gold.

Following the placement, Solstice’s cash reserves will be further strengthened. As of 31 March 2025, the company held A$13.6 million in cash and equivalents.

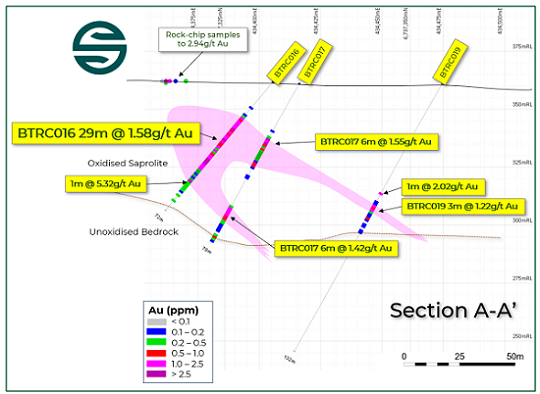

Bluetooth Discovery Strengthens Prospectivity

As previously reported by ACB News in early June—“Solstice Minerals’ Bluetooth Discovery Extends Over 800m; Stock Hits Three-Year High”—Solstice’s second phase of RC drilling at the Bluetooth prospect in Eastern Goldfields returned multiple zones of shallow, continuous gold mineralisation, suggesting strong potential to establish an initial resource base.

The Yarri Project spans 1,650km² in the highly endowed Eastern Goldfields, with excellent infrastructure access. Meanwhile, Nanadie is advancing toward its next drilling phase.

Solstice has flagged steady exploration updates into H2 2025, with multiple campaigns in motion.

ACB News will continue to track Solstice’s exploration progress and institutional developments.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. While every effort is made to ensure accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Investment involves risk. Always seek independent, professional advice before making any financial decisions.