( Image: ACB News)

By ACB News Stock Market Editorial Team

While The company confirmed it had achieved its full-year FY25 run-of-mine (ROM) coal production and sales guidance , Bowen’s share price declined sharply prior to the trading halt, closing at A$0.096 on 23June, with the company’s market capitalisation falling at about A$10 million — a sharp contrast to the hundreds of millions it was valued at during the COVID-era peak.

ACB News|25 June 2025 — ASX-listed coal producer Bowen Coking Coal Ltd (ASX: BCB) announced on Tuesday, 24 June 2025, that it has requested a trading halt on its securities to advance funding discussions in response to continued coal market weakness and ongoing royalty pressures in Queensland.

The company confirmed that as of May 2025, it had achieved its full-year FY25 run-of-mine (ROM) coal production and sales guidance, with one month remaining in the financial year. Key operational highlights to date include:

——ROM coal production of 304,000 tonnes in May — the highest monthly output recorded for FY25.

——Year-to-date ROM production of 2.7 million tonnes and coal sales of 1.7 million tonnes

——Year-to-date FOB unit costs (excluding royalties) of A$150.6 per tonne

The company reaffirmed its aim to achieve the high end of its FY25 ROM coal production and coal sales guidance, and the low end of its FOB unit cost guidance for the year ending 30 June 2025.

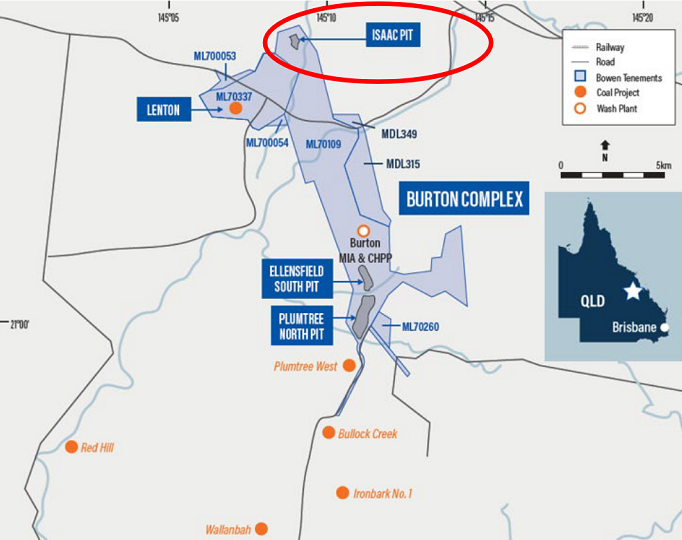

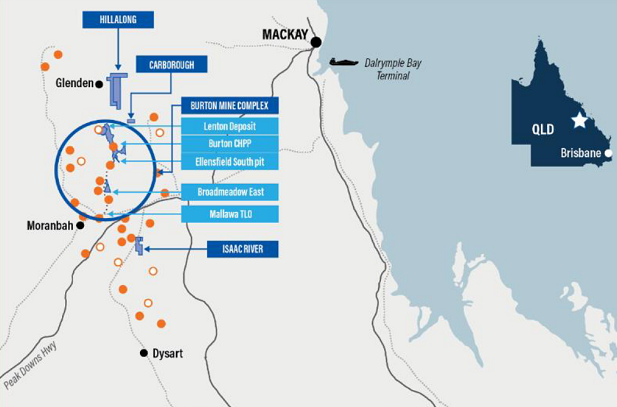

The company also reaffirmed that its Burton Mine Complex will transition to an owner-operator model from 1 July 2025, with operations to be managed internally. The transition is part of Bowen’s broader strategy to navigate ongoing pressure in global coal markets.

According to the latest update, the Platts Australia PLV metallurgical coal index has declined by 25% year-on-year to US$175/t, while API5 thermal coal is currently trading at approximately US$66/t.

The company highlighted the financial impact of Queensland’s progressive coal royalty regime, introduced in July 2022, which applies marginal royalty rates based on sale price brackets:

——Up to A$100/tonne: 7%

——A$100–150: 12.5%

——A$150–175: 15%

——A$175–225: 20%

——A$225–300: 30%

——Above A$300: 40%

Under this framework, any coal sold above A$175/tonne is subject to significantly higher marginal royalty payments, adding pressure to operating margins.

To maintain its current scale of operations and facilitate the Burton transition, Bowen is evaluating a range of funding options including debt, equity and hybrid instruments. The company also stated that if near-term funding is not secured and/or coal market conditions do not improve, it may consider temporarily pausing part or all of the operations at the Burton Mine Complex.

The trading halt took effect prior to market open on Tuesday, 24 June 2025, and is expected to remain in place until trading resumes on Thursday, 26 June 2025, or until an earlier announcement is made.

Prior to the trading halt, Bowen’s share price declined sharply, closing at A$0.096 on 23June, with the company’s market capitalisation falling at about A$10 million — a sharp contrast to the hundreds of millions it was valued at during the COVID-era peak.

In April 2025, Bowen completed a 1-for-100 share consolidation. Following the consolidation, the company’s revised share capital stands at approximately 107.8 million shares on issue.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. While every effort is made to ensure accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Investment involves risk. Always seek independent, professional advice before making any financial decisions.