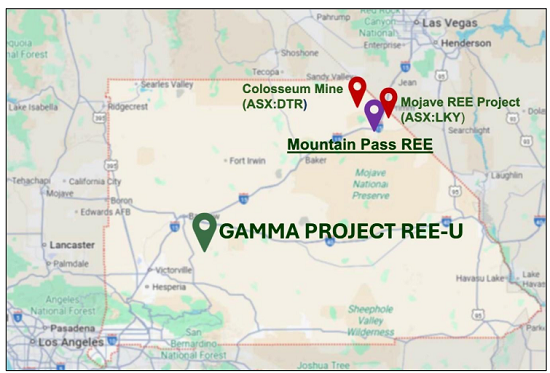

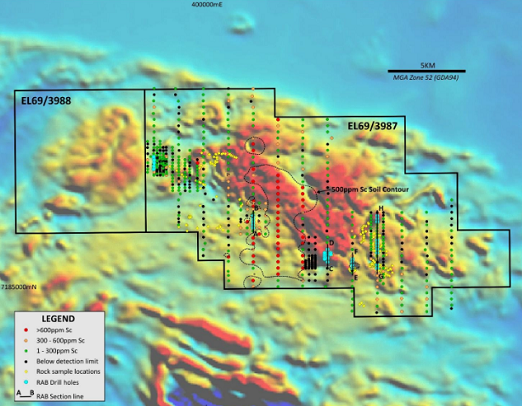

ACB News《澳华财经在线》8月23日讯 “供应断崖”日渐迫近的情况下,全球铜矿行业正在发生久违的躁动。

今年4月中国矿企巨头紫金矿业(601899.SH)向在蒙古从事大型斑岩铜金矿床勘探的Xanadu仙乐都矿业(ASX澳交所股票代码:XAM,多伦多交易所股票代码:XAM)伸出橄榄枝,计划从公司和项目层面为XAM提供双重支持,共同推动十亿吨级的哈马戈泰项目尽速迈入开发阶段。

Xanadu执行董事会主席Colin Moorhead 先生,整个职业生涯一直投身铜金矿行业,有着极强的技术背景,曾长期担任纽克雷斯特技术部门主管,作为创始管理团队成员,全程推动著名的卡迪亚谷超级铜金矿场开发,而他曾任首席执行官的Merdeka铜金矿公司股价更是在过去五年上涨超过7倍。

Moorhead 先生近日接受ACB News《高管访谈》栏目视频采访时表示,哈马戈泰不仅仅是一个大规模资源项目,由于具有低ESG风险,相信它将成为全球开发进度领先、率先进入投建阶段的大型铜矿场之一。

对于像Xanadu这样的小公司而言,最大的挑战之一就是在获得像哈马戈泰这样一个大项目后,如何获取融资并开展矿场建设,“这就像抓着老虎尾巴”,而与紫金矿业的合作则成为需求和专业知识的完美结合。

哈马戈泰具有哪些独特优势,令作为行业资深专家的Moorhead另眼相看并全情投入?Xanadu与紫金矿业的合作将赋予哈马戈泰项目哪些新的优势?应如何从财务角度理解哈马戈泰概略研究?

哈马戈泰将如何应对矿产资源品位、开发环境和开发条件方面的挑战,技术革新会在这一过程中扮演怎样的关键角色?未来该项目又将在满足全球,尤其是中国市场需求方面发挥怎样的作用?

具体详情请点击上方视频链接,观看本期《高管访谈》视频,同时您也可以阅读我们精心准备的访谈内容精编版(含中英文):

Xanadu执行董事会主席Colin Moorhead 先生(图片来源:《澳华财经在线》)

——Xanadu执行董事会主席Colin Moorhead 访谈全文——

ACB News《澳华财经在线》:您的职业生涯始于必和必拓(ASX:BHP),随后在铜金矿业公司Newcrest Mining(ASX:NCM)取得辉煌成绩,最近曾担任Merdeka铜金矿公司(IDX:MDKA)首席执行官,在印度尼西亚成功开发一个项目,而Merdeka股价在过去5年上涨713%,可谓大放异彩。首先能谈谈您的职业背景吗?该背景是如何影响您对Xanadu仙乐都矿业的领导方式的?

Colin Moorhead:我是一名在实践中逐渐培养起来的地质学家,早年曾在两家非常优秀的矿业公司必和必拓和纽克雷斯特的矿山工作,在铜金矿勘探方积累了大量实际工作经验。

随着资历渐长,我开始担任纽克雷斯特Telfer金矿的首席地质学家职务,随后加入卡迪亚谷(Cadia Valley)创始管理团队,参与该项目运营。这是座超级铜金矿项目,包括著名的卡迪亚 Ridgeway以及现在的东卡迪亚巨型矿藏。此后,我前往印尼资源非常丰富的Gosowong金矿工作了一段时间。所以我整个职业生涯一直从事铜金矿行业,可以说有很强的技术背景。

2008年我成为纽克雷斯特矿产业务执行董事会主席、董事总经理,全面负责纽克雷斯特的地质工作。依靠持续的创新和勘探,纽克雷斯特已经成长为一家大公司,而我在纽克雷斯特工作的8年,一直引领其全球勘探和开发工作。因此,世界上几乎没有一个铜或金矿床是我从未曾见过的或研究过的,无论是在矿体形态或是结构形式方面。

在纽克雷斯特工作期间,我一直对印尼的Tujuh Bukit矿床很感兴趣。2016年我加入Merdeka担任该公司首任CEO,主要负责在Tujuh Bukit斑岩铜矿藏上方建设氧化金矿场。矿场的建设非常成功,帮助Merdeka获得大量基础现金流,为公司最终飞跃式发展提供重要助力。当时,我们也启动了Tujuh Bukit的概略研究和预可研(PFS)。

因此,我拥有大量的矿业技术背景,尤其对斑岩铜矿有着深刻理解,并且在澳大利亚和亚洲拥有丰富的矿山开发和运营经验。

我对Xanadu仙乐都矿业的看法正是在这些经历的基础上形成的。Xanadu许多方面与卡迪亚非常相似。它的旗舰资产位于一个斑岩铜矿带上,而这里可能已形成极为庞大的斑岩系统。新冠肺炎疫情爆发之前,我曾访问位于南戈壁的哈马戈泰,当地斑岩系统蕴含的高品位矿体令我印象十分深刻。我觉得如果我们能够找到开发这些高品位矿石的方法,这里最终可以建起一座矿场。

ACB News《澳华财经在线》:今年4月,Xanadu宣布与紫金矿业建立战略合作伙伴关系,紫金矿业将分三个阶段对仙乐都及哈马戈泰项目进行投资,并计划与Xanadu成立合资企业共同开发哈马戈泰项目。请您详细介绍一下这项合作交易,以及这项合作关系对Xanadu的项目开发有何益处?

Colin Moorhead:对于像Xanadu这样的小公司而言,最大的挑战之一就是在获得像哈马戈泰这样一个大项目后,如何获取融资并开展矿场建设,“这就像抓着老虎尾巴”。

Xanadu拥有高度专业的勘探技术和知识,而紫金矿业拥有强大的资产负债表,并且在建设运营大型铜矿场方面具有丰富经验和久经验证的能力。因此,这是需求和专业知识的完美结合。一家初级公司是很难筹集到建设大规模矿场所需的资金的,我认为我们可以一起推动这个项目。

紫金矿业将以约定价格从公司层面对Xanadu进行投资,最终持有XAM大量股份,持股份额达到19.9%,成为公司最大股东。在项目层面,紫金矿业将投资3500万美元,这足以支持项目走过下一阶段,即完成预可研报告。

期间XAM还将投入700万至1000万美元开展钻探,并使用大约同样的资金推进冶金、岩土工程等各方面研究,以及寻求相关许可和审批。因此,我们现在有足够资金来支持自己直到采矿决议阶段,而这也是初级公司开发大型项目的主要障碍之一。

哈马戈泰不仅仅是一个优质项目,它还享有足以推进到采矿决议阶段的资金支持。并且我相信,由于具有低ESG风险,它将成为全球开发进度领先、率先进入投建阶段的大型铜矿场之一。

(图片来源:《澳华财经在线》)

ACB News《澳华财经在线》:哈马戈泰铜金矿项目的概略研究已在今年4月发布。您能否简要总结一下这项概略研究涉及哪些关键内容?可否从财务角度谈谈?

Colin Moorhead:从定义上说,概略研究是指一个项目通过开发可以达到怎样的成果,预可行性研究是应该怎样开发这个项目,而可行性研究是将要采取的具体步骤。

就哈马戈泰而言,它是一处10亿吨级的矿藏,其中包含300万吨铜和800万盎司黄金。它的矿床规模巨大并有进一步增长的潜力,但为了便于开展工作,我们将其资源量划定为11亿吨。

我们能对这些资源做些什么?研究结果显示,该项目可以开展超大规模露天采矿作业,采用常见的卡车+电铲运营模式,使用标准技术在30年内提取约7亿吨至8亿吨的矿石,初期会采用年加工量达1500万吨的铜浮选回路,在回本期过后逐渐上升到每年3000万吨。

最终这座矿山在30年的开采周期内,平均每年可生产3.5至5万吨铜以及超过10万盎司黄金。值得注意的是,这样的评估结果尚未将技术创新因素考虑其中,包括采用任何降本或者生产方面的新技术。

哈马戈泰项目前期资本投入约为6亿美元。对于我们这样的小公司来说,是一笔巨大的资金,这就是为何我们需要紫金矿业的支持。按照四美元的铜价计,项目净现值约为6亿美元,加之由于能够生产黄金副产品,该项目可以说具有相当出色的资本效率。

成本方面,在最初的五年生产铜的总维持成本相当低,处于行业第一四分位,整个矿山寿命期内,单位生产成本可保持在中值水平。

哈马戈泰享有十分有利的基础设施条件,水电供应、道路铁路设施一应俱全。一直以来蒙古政府在该地区的基础设施建设上投入大量资金,并做到与中国的铁路标准接轨。

产出方面,哈马戈泰生产的铜精矿极其干净,几乎没有砷、氟和其他杂质,属于高品质精矿,适于向南部运输出口到中国冶炼厂,并且运输成本非常低。

因此,哈马戈泰是一个低成本、长寿命矿场,一旦建成技术风险和ESG风险都非常低。从很多方面看,这都是一个非常强大的项目。

在概略研究评估结果之上,哈马戈泰的经济价值仍有较大提升潜力。在概略研究的模型中,覆盖在硫化物上方的氧化物被认定为废物。这部分材料的剥采比非常低,小于1:1即每一吨矿石的废料量小于一吨。目前氧化物材料被看作废料,但根据测试结果,通过浸出工艺可以该材料中回收铜和金。也就是说可以‘变废为宝’,有可能通过处理氧化物材料增加项目的实际价值。

(延伸阅读《9千万吨地表材料“变废为宝”!Xanadu哈马戈泰高级铜金矿项目现金流有望大幅提升》)

目前Xanadu团队正在研究通过坑内破碎和运输技术,降低运输成本,以及通过粗颗粒浮选和矿石分选,提高待研磨的矿石品位。所有这些价值增长机会都还没有纳入到项目远景分析中。哈马戈泰本身已经具有强劲的吸引力,而我们相信可以让它更具吸引力。

勘探方面的增长潜力也不容小觑。Xanadu团队认为,哈马戈泰地底深处可能存在更高品位的矿化,未来有可能建成地下矿场。所以在我们看来,它是一个非常激动人心的项目。

(图片来源:《澳华财经在线》)

ACB News《澳华财经在线》:您提到哈马戈泰获得周边环境的充分支持,但有媒体评论称哈马戈泰的矿产资源总体品位不高,开发环境和开发条件具有挑战性。可否谈谈你对这些评论的看法?

Colin Moorhead:矿石品位很受关注,但品位并不是利润的唯一驱动因素。在采矿作业上真正重要的是每吨利润。资源规模和黄金副产品都是哈马戈泰的加分项。单纯从铜的角度看,它矿石品位是比较低,但与一些大型矿山(如东卡迪亚和奥尤陶勒盖)处理的矿石相比,品位已经非常好了。

真正的驱动因素是铜矿所含的黄金量。如果具备规模优势,考虑到规模经济以及副产品特性,实际上可以产生很好的每吨利润。因此,仅仅看品位,并不真实。

我曾参与卡迪亚项目,该项目始于20世纪90年代末,当时人人都说它的品位太低,不值得开发。卡迪亚有着和哈马戈泰类似的基础,资源规模和副产品特点很像,而最终它成为了21世纪初最成功的矿山之一。卡迪亚和奥尤陶勒盖大获成功的另一因素是后来发现的高品位材料,而从卡迪亚、里奇韦以及奥尤陶勒盖的案例中可以看到,蒙古南部是真正的潜力区域。所以我认为仅仅看品位并不是评估项目价值的合理方法,需要关注的是每吨利润率和投资回报率。

哈马戈泰的另一大优势是它的周边环境。我曾在巴布亚新几内亚和印度尼西亚的山区建设矿山,当地的环境才是充满挑战。相比之下,能够找到像哈马戈泰这样一个地势平坦、人口稀少、地震构造稳定的地方,十分难得。从ESG风险的角度来看,开发新矿山面临的最大问题是如何在山区地带和地震活动活跃的情况下管理废物和尾矿,而哈马戈泰没有这些问题,我们只需要建立常见的尾矿储存设施和废料堆放场即可。“我认为在一个越来越关注ESG风险的世界里这一点非常具有吸引力。”

ACB News《澳华财经在线》:您多次提到ESG,ESG在矿业领域是一个非常受欢迎和非常必要的话题。你能从ESG的角度谈谈Xanadu独特之处吗?

Colin Moorhead:我相信进行采矿作业只有一种正确方法,那就是始终对环境、社会和社区问题给予最高关注。如今ESG已成为一个热门话题,但对我来说,它意味着在员工及社区、政府、股东以及财务投资方的诉求和需求之间取得平衡。每个人都希望从项目中获得平衡的回报。如果采取的方式正确,项目就会成功,而如果一个方面失败,整个项目可能会失败。这是一个有关平衡之道的练习。

哈马戈泰的突出优势是它位于采矿区内。项目所在的朝格特车齐县坐落着力拓旗下巨大的奥尤陶勒盖铜金矿,还有塔温陶勒盖煤矿。当地基础设施完备,有着浓厚的矿业文化,人们受过良好的教育和培训,并寻求从矿山获得的工作机会和经济利益。其矿业生态系统有脆弱之处,理应受到尊重和保护,但并非难于管理。

正如我所说,哈马戈泰的位置不在山区,也不在地震高发或者降雨量大的地区。项目所在地地势平坦,因而风险更低,可以更好地管理废物和尾矿。

Xanadu与其他勘探公司不同的一点是,它有自己的可持续发展报告,并且刚刚发表了第二版。

“大多数勘探公司并不会准备这项报告,但许多运营阶段的公司都会这么做。我们很早就开始发布可持续发展报告。我希望《澳华财经在线》的听众和读者可以看看这份报告,它实际上很有价值,包括清晰的案例研究,说明我们正在做什么以支持当地社区,以及我们如何管理项目开发过程中的安全和环境问题。

“我认为我们完全有能力在南戈壁建立一个有时代特色、具有低碳排放水平并且可持续运营的矿场,而只有建设哈马戈泰这样高标准ESG项目,才可满足全球市场对铜的未来需求。”

(图片来源:《澳华财经在线》)

ACB News《澳华财经在线》:Xanadu在蒙古运营着两个铜金矿项目,包括旗舰项目哈马戈泰和初级勘探项目红山。当初加入Xanadu时,是什么吸引你来到蒙古参与这些铜金矿项目?加入Xanadu后,你在蒙古又遇到了哪些挑战?

Colin Moorhead:南戈壁有一些火山带,这些火山带蕴含斑岩和斑岩相关的铜金矿系统,具有很高勘探前景。哈马戈泰即存在这样的斑岩系统,并与卡迪亚项目以及力拓的巨型奥尤陶勒盖(Oyu Tolgoi )项目有很多相似处。它的资源增长潜力,以及在矿化系统中发现高品位矿体的潜力,让我感到非常振奋。世界需要铜,像哈马戈泰和红山这样的项目可在不久的将来产出铜矿以满足市场需求。

蒙古是一个位于俄罗斯和中国之间的内陆国家,很值得关注。在这里最大的挑战并非那些常见的挑战,譬如与ESG相关的人员福祉方面的挑战、基础设施相关的挑战等,世界上大多数铜矿项目都面临这些挑战。但在蒙古,情况有所不同。

我认为蒙古的问题在于它是一个相对较新的民主国家,目前仍在整理采矿法。有人会认为蒙古是一个不稳定的司法管辖区,力拓与蒙古政府之间由于奥尤陶勒盖(Oyu Tolgoi)项目存在持续争议,突显出这一事实。然而在力拓和蒙古政府的共同努力下,相关问题现在已基本解决,从这点可以看出蒙古正努力寻求改善外国投资者的看法,并且该国正努力制定更透明、更具竞争力的采矿法规。

这其实关乎融资,投资者需要稳定的司法环境和清晰的法规。在过去人们认为蒙古在这方面一直有所欠缺。但我觉得蒙古正朝着正确的方向快速前进,未来会成为主要的铜产地司法管辖区之一。

随后我们将发布《Xanadu专访(下):“世界需要铜” 哈马戈泰将成全球下一超级铜金矿场 紫金矿业提供完美助力》,敬请保持关注。

免责声明:本网所发所有文章,包括本网原创、编译及转发的第三方稿件及评论,均不构成任何投资建议,交易操作或投资决定请询问专业人士。

——附:访谈(上)英文版——

(Part I)

ACB News《澳华财经在线》:You started your career as a BHP graduate and later went on to an illustrious career at copper and gold miner, Newcrest Mining (NCM.ASX), and more recently lead Merdeka Copper Gold (MDKA.IDX) as CEO successfully developing a project in Indonesia. the stock went up 713% in last 5 years. That's amazing, Can you talk through your background and how this has shaped your leadership approach at Xanadu Mines?

Colin Moorhead: Sure, as I said, I'm a geologist by training and my early years were shaped working for very good company in BHP and Newcrest. So I spent a lot of time on the ground in working in both mines and in exploration mostly in copper and gold.

As I became more senior, I held leadership positions at Newcrest Telfer Gold mines Chief geologist and then was on the startup management team for the Cadia Valley operations which included Cadia Ridgeway and the current giant Cadia East deposit.

And after that a stint at the very rich Gosowong gold mine in Indonesia So I've been in copper and gold all my life, with a strong technical background. In 2008 I became the Executive Chair, Executive General Manager of Minerals for Newcrest which is basically responsible for all things geology at Newcrest.

Newcrest had grown to become a large company based on which are grown on innovation and exploration and I was part of that team 8 years at Newcrest leading global exploration and development. So there is hardly a copper or gold deposit in the world that I haven't seen or looked at in some way, shape or form.

I was always interested in the Tujuh Bukit deposit in Indonesia. And in 2016, I joined Merdeka as their inaugural CEO and that job was basically building the oxide gold mine that sits above the Tujuh Bukit porphyry copper deposit. That was a very successful construction and that mine has become the base cash flow that's made Merdeka very successful. And at that time we also started the scoping study and PFS in Tujuh Bukit.

So I come from a sort of a broad technical background with deep understanding of porphyry copper deposits and I have good experience in Australia and in Asia in developing and operating mines.

So that's shaped my views of Xanadu. Xanadu is very similar in many ways to Cadia. It's in a porphyry copper belt that has potential for very large porphyry systems and I was able to visit Kharmagtai in the South Gobi just prior to Covid sitting in and what struck me was there was some very relatively high grade components to the system and I felt that If we could resolve those high grade components we could We could turn this operation into something that would eventually be constructed.

ACB News《澳华财经在线》:This April, Xanadu announced that a strategic partnership has been built up between Zijin Mining and Xanadu and Zijin will invest in Xanadu and its Kharmagtai project through 3 stages, Eventually create a Joint venture to develop the Kharmagtai project. Can you please give more details about the partnership. How does the partnership benefit Xanadu’s project development?

Colin Moorhead: Of course, yes. One of the largest challenges for a small company like Xanadu when it gets hold of a big project like Kharmagtai. it's like having the tiger by the tail, you know, So how do you finance and construct a large project. Xanadu brings serious technical and exploration expertise. Zijin brings a strong balance sheet and clear and demonstrated capability to construct and operate large scale copper operations. So it's a perfect marriage of need and know how And I think together we can we can move this project forward whereas it's very difficult for a junior company to find the financiers required to build such a large scale operation. The deal itself involves Zijin investing at the Xanadu at the listed company level up to 19.9% at an agreed share price, which gives them a significant stake in the company they will be the company's largest shareholder. At the project level, Zijin will be investing $35 million US dollar in at the project level, which is more than enough to fund the project through its next phase, Which is the pre-feasibility phase. That will involve approximately 7 to 10 million dollars worth of drilling. And that much again in studies around metallurgy, geotechnical and all those things And we'll also seek go forward with the permitting and approvals process, so we have enough money now to fund ourselves up to that decision to mine, Which is one of the major hurdles for a junior company with large projects, So not only is Kharmagtai is a good project,it's also well-funded to that decision to mine and I believe will be due to its low ESG risks will be one of the next major copper mines to be constructed in the world.

ACB News《澳华财经在线》:Scoping study for Kharmagtai Copper-Gold project was released in April. Could you please briefly summarize scoping study project metrics? Could you please talk through scoping study from a financial point of view?

Colin Moorhead: Sure, so by definition, a scoping study is what you could do with a project and Pre-feasibility study is what you should do and then a feasibility study is what you will do. So scoping study. Okay, we've got, you know a billion tonnes that contains three million tonnes of copper and 8 million ounces of gold so a large deposit with potential to grow even further. But for the sake of this exercise we ruled our line under it at 1.1 billion tonnes.

So what can we do of this and the outcome of that study was a very large, vanilla open-pit operation based on normal truck and shovel operation so standard technology extracting approximately 700 to 800 million tonnes of that resource over a 30-year period initially feeding a 15 million tonnes per annum copper flotation circuit ramping to a thirty million tonnes per annum circuit after the initial payback period. That gives us a mine that produces 35 to 50 thousand tonnes of copper per annum and over one hundred thousand ounces of gold per annum over a 30-year mine life.

And that's before we add any technical risk. In terms of new technologies to bring the cost down, or the production up which I can talk about a little bit in a minute. So the outcome of that was an operation that had an upfront capital of approximately 600 million dollars which is large for a small company like us which is why we needed Zijin in there.

And a NPV, based on a four dollar copper price of about 600 million. So quite a good capital efficiency ratio, Importantly due to the gold by-product credits. Quite a low overall sustaining cost of producing copper initially in the first five year period,first quartile and over the life of mine around the median cost per pound of copper produced.

So it's a low-cost long life mine once it's built that is based on very low technical and very low ESG risk. And what that means is due to the strong support of infrastructure in the area. We have power, we have water, we have road, we have rail, we have. The Mongolian government has been investing a lot in infrastructure in that part of the world particularly in terms of railing standard in China.

So we will be producing a copper concentrate. It's very clean has very little arsenic and fluorine and other impurities. So it's a very nice concentrate which can be exported south to smelters in China with a very low transport costs so in many ways it's a very strong project.

It does have the upsides of, at the moment the oxide material that sits above the sulphide is considered waste in our model. A very low strip ratio less than 1:1. So less than one tonne of waste for every one tonne of ore. And at the moment that oxide material is waste. We believe, based on leach testing results that we can recover copper and gold from that material. That will turn that waste liability into an opportunity. So there's potential to add serious value by processing the oxide.

We are also able to look at in-pit crush and convey technologies to get the haulage cost down then also coarse particle flotation and ore sorting to improve the grade to the mill. So all of those opportunities are yet to be built into that scenario. So it's already an attractive project. We believe we can make it more attractive and, of course, there’s exploration upside. We still believe that there's potential at depth to support higher grade mineralization which could be a future underground mine. So we see it as a, you know a very exciting project at this point in time.

ACB News《澳华财经在线》:It's interesting that you mentioned that Kharmagtai project has enough support from the surrounding environment and there are media comments that the overall grade of the mine resource in the Kharmagtai project is not very high and the development environment and conditions are challenging. Can you please share your thoughts on those comments?

Colin Moorhead: Sure, in terms of grade you know people look at grade, but grade isn't the only driver of margin and what you really need in a mining operation is margin per tonne. So this project works on scale and on by-product credits. So, on a pure copper basis we’re reasonably low grade but we compare very well to the grades being treated at some of the big mines, such as Cadia East and Oyu Tolgoi at the moment.

But what drives this thing is the amount of gold that comes with the copper. So if you have the scale, the economies of scale and the byproduct credits you can actually generate a very good margin per tonne. So it's a bit of a falsehood looking at just grade.

I was involved in the Cadia project which started up in the late 1990s and everybody said that was too low grade to work and it worked on the same basis scale and by-product credits and was one of the most successful mines of the early 2000s. The other thing that made Cadia great and the Oyu Tolgoi great was subsequent discoveries of high-grade material.

In the case of Cadia and Ridgeway, and the case of Oyu Tolgoi if you go south you know there's real potential here. So I think looking at just grade is not a sensible way to evaluate projects. You need to look at margin per tonne and return on investment. The beauty of Kharmagtai. you say it's a challenging environment, but you know I'm a bloke that spent his career building mines in the mountains of Papua New Guinea and Indonesia. Give me a flat sparsely populated seismically stable part of the world anywhere and I'd rather build a mine there.

So, from an ESG risk point of view, the biggest problem facing new mine developments is how do you manage your waste and your tailings, You know,in mountainous terrain and with active seismicity. well, we don't have any of those problems. We will be building a common vanilla tailing storage facility common vanilla waste dumps and I think that is very attractive in a world that is increasingly focused on those sorts of risks As they should be.

ACB News《澳华财经在线》:You mentioned ESG several times in this interview and we know ESG is a very popular and very necessary topic these days in the mining sector. Can you talk about key differentiating factors about Xanadu ESG Perspective?

Colin Moorhead: sure, you know. I believe there is only one way to do the mining and that's the right way which is with the highest regard to environment social and community issues and that's always been the case. It's become a bit trendy and popular these days but to me that means balancing your employees needs and wants with the community and government with your shareholders and financiers. so everybody needs a balanced return from a project and if you get that right the project will succeed. If you get one of those things wrong the project will probably fall over. So it's a balancing exercise.

The advantages of Kharmagtai in particular has, is that, It’s in a mining region. It’s in Tsogttsetsii soum, which has the giant Oyu Tolgoi copper gold mine owned by Rio Tinto and it also has the Tavan Tolgoi coal deposits. It's well supported by infrastructure and there is a strong mining culture in that part of that country and the people are well educated and well trained and seeking to those jobs and economic benefit that comes from the mines it's a delicate ecosystem and needs to be respected, but it's not one that can't be managed relatively easily.

As I said we're not in the mountains somewhere not in high seismic, high rainfall terrain. We're in flat ground which makes the risks just lower, so, as I said we can manage our waste and tailings much better.

One thing that differentiates Xanadu from other exploration companies is, we do have a sustainability report. We've just published our second. Most exploration companies don't have these. Most operating companies do. So we've started early and put a sustainability report out. And I would point your listeners and readers to that report because it is actually quite a good document with good case studies on what we're doing to support the local community and what we are doing to manage safety and environment in our project. But I think we are well placed to build a contemporary low carbon footprint sustainable operation in the South Gobi, And I think it's projects like Kharmagtai that will be constructed to supply the copper, the copper needs of the globe going forward.

ACB News《澳华财经在线》: So Xanadu operates two Copper-Gold projects in Mongolia flagship project – Kharmagtai Project and Red Mountain project. When you joined Xanadu, what was it that attracted you to these Copper-Gold projects in Mongolia? Right Since you've been involved with Xanadu, what in country challenges have you faced?

Colin Moorhead: As I said before, it's the South Gobi contains some volcanic belts that are highly prospective for porphyry and porphyry related copper-gold deposits. At Kharmagtai I saw a system that has a lot of similarities to Cadia and a lot of similarities to the giant Oyu Tolgoi project which is a Rio Tinto project that I felt that, you know, that growth potential as well as the potential for high grade components to the system, was very exciting. the world needs copper and I feel that it's projects like Kharmagtai and possibly Red Mountain that will provide the copper into the near future.

It's an interesting country, of course being landlocked between Russia and China. Probably the biggest challenge is not so much the normal challenges. The normal challenges, people Issues associated with ESG and infrastructure most copper projects around the world have those challenges. Not so much in Mongolia. I think Mongolia's problem is a relatively new democracy is that they're still sorting out their mining law. So there was perceptions that Mongolia was an unstable political jurisdiction. Highlighted by the fact that there was an ongoing dispute between Rio Tinto on the Oyu Tolgoi project and the Government of Mongolia. That has largely resolved itself now which I think is a credit to both Rio Tinto and the Government of Mongolia.

And when you look past that, I think Mongolia is really looking to improve their perceptions around foreign investment into Mongolia, and I believe working towards a more transparent and competitive mining codes. So it's really in terms of financing. You need stability and clarity and you know, there's been perceptions that it’s been lacking in the past. But I feel Mongolia is very quickly moving in the right direction and will be a major copper jurisdiction moving forward.

(To be continued)

【小编贴士:】手机端阅读时,点击文章页面左上Logo即可返回首页阅读。祝读者朋友天天健康、开心!工作投资顺利。

免责声明:本文为财经观察评论,不构成任何投资建议,交易操作或投资决定请询问专业人士。

(郑重声明:ACB News《澳华财经在线》对标注为原创的文章保留全部著作权限,任何形式转载请标注出处,图片来自网络。)