From resource quality to engineering cadence, the project narrative is shifting beyond exploration

By David Niu | ACB News

In the resource sector, valuation inflection points rarely come from the mere existence of ounces in the ground. What ultimately separates an enduring mining story from a speculative one is whether the resource base is technically credible, expandable under realistic economic assumptions, and supported by an execution pathway that can be validated by engineering and capital.

That is precisely why Flagship Minerals Limited (ASX: FLG) has begun drawing renewed market attention. The company’s Chilean Pantanillo Gold Project, located in the Maricunga Gold Belt, is increasingly being framed not simply as an exploration asset, but as a project transitioning toward an engineering-driven development narrative.

Resource quality as the first principle: 1.05Moz is not just scale — it is structure

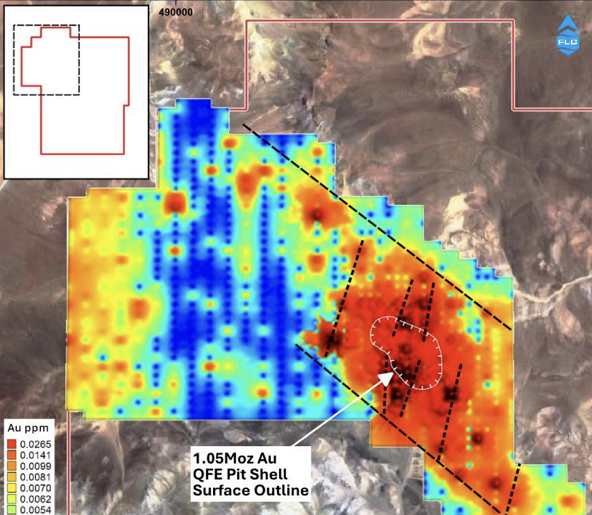

Flagship Minerals holds Pantanillo under an option agreement, with the project currently reported to host approximately 1.05 million ounces of gold under a NI 43-101 compliant Qualifying Foreign Estimate (QFE) — a foreign estimate not reported under the JORC Code (2012).

At face value, a million-ounce gold resource is not unusual globally. But within the context of the ASX junior market, it is less common to see an asset of this size attached to a company with a market capitalisation around A$70 million.

More importantly, Pantanillo’s value proposition does not rest solely on scale. It rests on the quality of its resource classification.

Based on the company’s disclosed NI 43-101 QFE, the project contains:

47.40Mt @ 0.69 g/t Au, for approximately 1,050.6koz of contained gold, using a 0.30 g/t Au cut-off grade and a gold price assumption of US$1,035/oz.

What stands out is the resource confidence profile:

Measured resources account for more than 79% of total ounces

Indicated resources account for more than 20%

Inferred resources represent less than 1%

In junior gold projects, resource inventories often skew heavily toward Inferred ounces. Pantanillo is the opposite. Its Measured and Indicated dominance implies higher drilling density, stronger geological continuity, and greater technical certainty.

In practical terms, Pantanillo’s current resource base is closer to being an engineering-ready foundation than a conceptual exploration narrative.

1.05Moz is not static: cut-off grade re-rating introduces structural upside

Flagship has repeatedly emphasised that the current resource estimate is not necessarily the end point of Pantanillo’s resource story.

Paul Lock, Flagship’s Managing Director and a major shareholder of the company, brings more than 25 years of cross-sector experience spanning mining, finance and commodities markets. He previously served at Rothschild & Co Australia as a derivatives trader and high-yield bond investment manager — a background that combines capital markets perspective with resource sector insight.

In a prior interview with ACB News, Lock noted that the existing NI 43-101 resource model reflects a gold price environment from around 2010 and applies a 0.30 g/t Au cut-off grade, which he described as conservative under today’s pricing and peer benchmarking context. (see: “Strategic Entry by Shandong Xinhai: Pantanillo Moves into a Critical Engineering Advancement Phase”).

In the Maricunga belt, comparable development-stage projects operate with cut-off grades closer to 0.15 g/t Au.

The implication is clear: even without incremental drilling, a recalibration of economic parameters and cut-off grade assumptions could potentially bring additional mineralised zones into the resource envelope, improving both scale and flexibility.

This is one of the drivers behind Flagship’s stated strategy to progress toward a JORC 2012 Mineral Resource Estimate (MRE). The company has also indicated it may release an updated NI 43-101 resource alongside JORC reporting, broadening its accessibility to international investor pools.

ASTER remote sensing: new evidence the system remains open-ended

While cut-off grade optimisation represents “internal upside”, Flagship’s recent ASTER satellite remote sensing interpretation introduces a second, more directional narrative — external expansion potential.

In an announcement released on 6 February, the company reported that ASTER mapping has identified extensive alteration mineral footprints across the Pantanillo tenure. The interpretation includes two major alteration corridors, each extending over 5 kilometres in length and up to 2 kilometres in width.

Flagship stated the alteration mineralogy is consistent with a high-sulphidation epithermal–porphyry model, and highlights multiple surface and near-surface targets, with deeper targets inferred.

In large-scale gold systems, broad alteration footprints are frequently viewed as a key indicator of mineralising architecture. Remote sensing does not define ounces, but it can materially improve targeting efficiency and drill prioritisation — particularly where alteration intensity and continuity suggest system-scale mineral potential.

The significance is amplified by Pantanillo’s location.

In a previous interview with ACB News, Paul Lock described Maricunga as a belt defined by one word: scale. Within a 40km radius of Pantanillo, the belt hosts over 65 million ounces of gold resources, including major tier 1 deposits such as Rio2’s Fenix, Kinross’ Cerro Maricunga and Lobo-Marte, Hochschild’s Volcan, and Barrick-Newmont’s Norte Abierto.

Within that geological context, Pantanillo is increasingly positioned not as a standalone licence, but as part of and essentially in the centre of a proven Tier-1 mineral province.

From geology to engineering: multiple development workstreams now running in parallel

Ultimately, resource quality alone does not convert into valuation. The market tends to reprice development stories when projects begin generating engineering evidence — metallurgy, permitting pathways, infrastructure visibility, and execution credibility.

Recent disclosures suggest Flagship is advancing Pantanillo across several development-critical fronts:

——Metallurgical testwork: samples have been shipped to Xinhai’s laboratory facilities in China, entering active test phases.

——Permitting and social licence: Environmental Impact Assessment (EIA) baseline work has commenced, supported by community engagement preparation.

Water security: the approval of the ENAPAC Ruta Este desalinated water pipeline introduces a structural improvement to the regional infrastructure outlook.

——Project sequencing: Flagship’s recent investor material outlines a staged roadmap from JORC MRE conversion → drilling validation → metallurgical parameter confirmation → MRE update → Preliminary Feasibility Study (PFS).

Collectively, these workstreams suggest the project narrative is shifting: Pantanillo is moving from resource definition toward engineering verification.

Xinhai’s strategic entry: funding plus execution capability

A key catalyst in Flagship’s evolving positioning is the entry of Shandong Xinhai Mining Technology & Equipment Inc. (Xinhai) as a strategic investor.

Flagship completed a A$4 million placement, of which Xinhai subscribed A$2.5 million, making it the most significant cornerstone participant in the raise.

Unlike conventional financial investors, Xinhai is an established EPC/EPCM+O mining contractor with end-to-end capabilities across metallurgical engineering, process design, procurement, mine construction, commissioning and operations support.

For Pantanillo, this represents more than capital injection — it introduces practical execution leverage.

Flagship disclosed that Xinhai completed a five-person on-site due diligence program spanning metallurgy, geology, mine engineering, design and project management, including a review of the drill core database and field conditions.

The company further disclosed that Xinhai’s second tranche payment of A$1.25 million was completed, confirming full settlement of its A$2.5 million commitment. A Xinhai nominee joined Flagship’s board in January 2026.

Paul Lock previously described Xinhai’s role as providing “Construction Credibility” — a term that carries weight in development-stage mining markets. At a time when global mining services capacity is constrained and project timelines are increasingly dictated by contractor availability, strategic alignment with an execution partner can become a differentiating advantage.

A defined milestone window: Pantanillo enters an engineering-validation phase

For junior resource companies, the real inflection point is rarely the first announcement of ounces. It is when the narrative begins to be tested — and confirmed — by engineering, timelines and measurable milestones.

Pantanillo now exhibits several traits associated with that transition:

——a high-confidence resource base dominated by Measured and Indicated ounces

——a credible pathway for resource growth via economic parameter recalibration

——a new layer of exploration optionality implied by system-scale alteration footprints

——parallel development workstreams covering metallurgy, water security and permitting

——strategic capital paired with engineering execution capacity

The next market-sensitive variables will likely include JORC conversion outcomes, metallurgical test results, permitting cadence and drilling updates.

Pantanillo is no longer positioned purely as a potential project. It is increasingly framed as a project moving into the phase where value is determined by engineering proof.

Market valuation framework: EV/oz benchmarking highlights a pricing gap

Flagship has also provided investors with a simple but widely used benchmark:

enterprise value per ounce of gold (EV/oz).

In its disclosed scenario, at a share price of A$0.21 and approximately 312 million shares on issue, Flagship’s market capitalisation is approximately A$65.6 million.

Based on 1.05Moz of contained gold, this implies an EV/oz of approximately A$61/oz.

Flagship compares this against a selected peer group of gold resource companies that have not yet reached feasibility stage, where the average EV/oz is shown as approximately A$149/oz.

This does not constitute a conclusion — but it provides a valuation coordinate. It also suggests that the market may not yet be fully pricing Pantanillo’s resource confidence profile, potential resource elasticity, or the execution pathway now being constructed.

As the company advances through key milestones — including JORC conversion, metallurgical validation, and staged engineering studies — the project will increasingly be judged not by narrative strength, but by measurable development outcomes. That is often where repricing begins.

Disclaimer & Editor’s Note:

This article is a company observation and market commentary prepared by ACB News for informational and editorial purposes only. It does not constitute investment advice and should not be construed as a recommendation, solicitation, or offer to buy or sell any securities. Investors are advised to conduct their own independent research and consult qualified advisers where appropriate.

This article is based on publicly available disclosures released by Flagship Minerals Limited (ASX: FLG), including its quarterly reports, investor presentations, and ASX announcements.