█ |By ACB News Stock Market Editorial Team

ACB News, Sydney 2 Oct 2025, Flagship Minerals Limited (ASX: FLG) announced on Tuesday that it had secured binding commitments to raise A$4.0 million (before costs) via a strongly supported share placement, including a cornerstone A$2.5 million investment from Shandong Xinhai Mining Technology & Equipment Inc, one of the world’s leading mining engineering, procurement and construction (EPC) groups, to fast-track development of its Pantanillo Gold Project in Chile.

The placement was priced at A$0.10 per share, representing a 28.6% discount to Flagship’s last closing price of A$0.14 and a 5.7% discount to the 10-day VWAP of A$0.106.

Xinhai’s investment will be delivered in two equal tranches of A$1.25 million, with the second tranche subject to the completion of a site visit to Pantanillo, the finalisation of a strategic partnership agreement and the appointment of Xinhai’s nominee as a non-executive director on Flagship’s board.

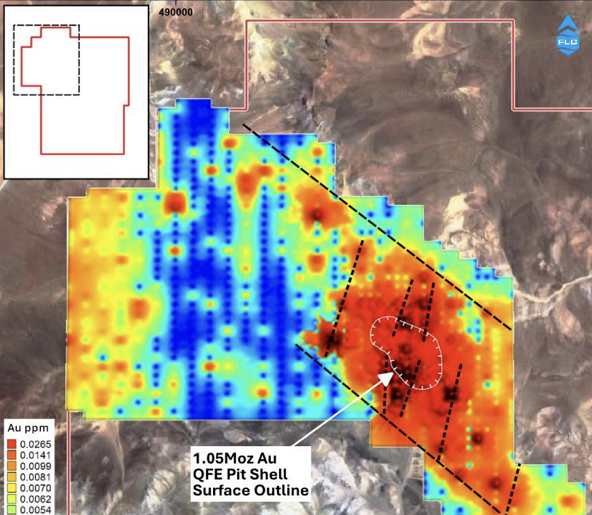

Proceeds will be directed to the conversion of the current NI 43-101 qualifying foreign estimate of 1.05Moz into a JORC (2012) Mineral Resource Estimate, metallurgical testwork and heap leach studies, drilling to support a resource update in 2026, and initial feasibility work. The company also intends to apply funds to working capital, ensuring momentum in its development program.

For Flagship, the partnership with Xinhai is significant beyond the financing. Xinhai has executed more than 500 EPC contracts globally, many including full mine construction and operations, and has built a growing presence in Latin America where it has supplied equipment to over 30 copper and gold projects and provided EPC services to more than 10. Its equity interest, technical expertise and board representation are expected to reduce execution risk and provide Flagship with access to proven capabilities in metallurgy, mineral processing, engineering and project financing.

Managing Director Paul Lock said the oversubscribed placement breaks the cycle of short-term option funding and positions the company to advance Pantanillo through feasibility and into development. He emphasised that Xinhai’s involvement represents a major step forward, combining financial capacity with technical strength to unlock a low-capex, near-term production opportunity. Flagship’s goal is to define sufficient resources to support open pit mining and heap leach processing capable of producing around 100,000 ounces of gold per year for more than a decade.

The latest placement builds on progress announced last week, when Flagship’s review of the extensive dataset acquired from Anglo American Norte SpA highlighted further expansion opportunities. Drill intercepts demonstrated broad mineralised widths, with many holes ending in mineralisation, indicating scope for down-dip and near-surface extensions. The review supports the interpretation of a mineralised corridor more than 500 metres wide, with potential to grow the current foreign estimate and enhance the project’s scale.

Flagship has secured an option to acquire 100% of the Pantanillo project, an advanced strategic gold play in Chile’s Maricunga Belt surrounded by tier-one majors and supported by world-class infrastructure. With the strategic partnership now in place, the company is positioned to accelerate the conversion of resources, advance feasibility studies and pursue development.

Disclaimer

The information provided on this website is for general informational purposes only and does not constitute financial or investment advice. While every effort is made to ensure accuracy, we do not guarantee the completeness, reliability, or timeliness of any content. Investment involves risk. Always seek independent, professional advice before making any financial decisions.